I-80 Gold – Comprehensive Update On The 3 Gold Projects And The Combined Polymetallic Project In Nevada

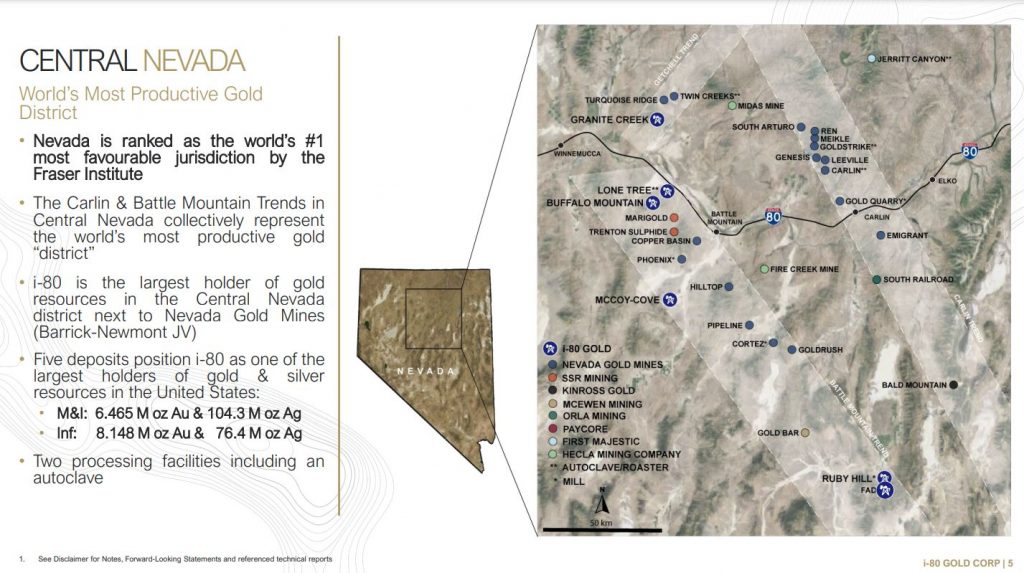

Ewan Downie, CEO and Director of I-80 Gold Corp (TSX: IAU – NYSE: IAUX), joins me for a comprehensive update on the work strategy at the 3 projects focused on the gold side of the business and on the additional combined polymetallic zinc-silver-lead-gold side of the business in Nevada.

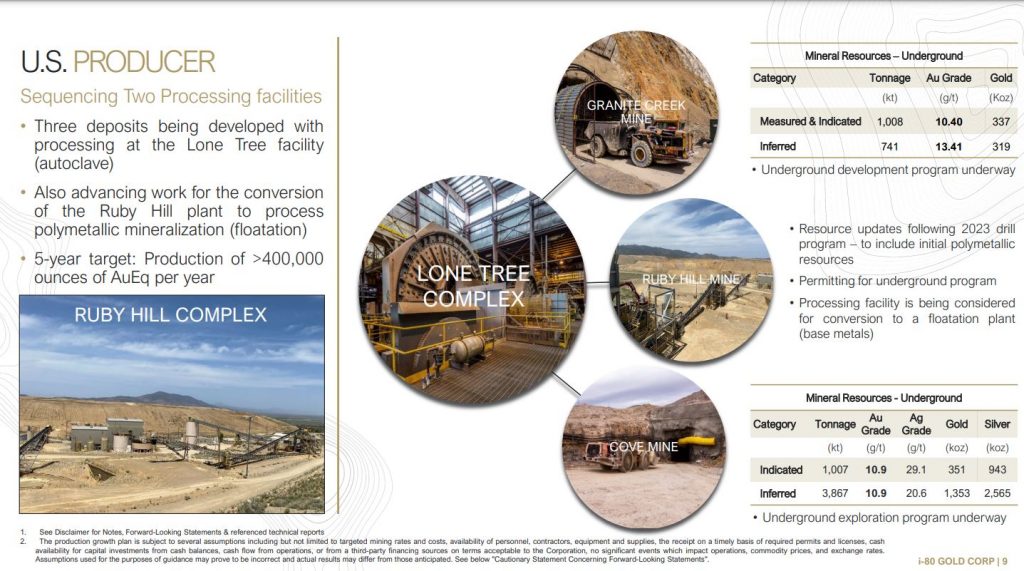

We kick off reviewing how production from Granite Creek is starting to ramp up from the OG and Otto Zones, but that the company is also starting to drift towards the higher-grade South Pacific Zone, discovered last year. The company looks forward to mining from the South Pacific Zone in 2024 as a further driver of production growth. There has also been plenty of additional exploration and development work going on at the Cove Mine deposit, and at Ruby Deeps, the gold dominant portion of the Ruby Hill Project. Ewan outlines the overall multi-year plan to develop all 3 gold mines into a substantial production growth profile, to eventually feed into their Lone Tree processing center and autoclave.

Next we shifted over to the continued exploration focus on bonanza-grade polymetallic mineralization at Ruby Hill from both the CRD mineralization being drilled at that Hilltop Zone, and the skarn mineralization at the Blackjack Zone. There will be more drill results to release to the market as they come back in from the lab from both areas over the next few months. Additionally, there has been ongoing drilling at the adjacent FAD Deposit, acquired from Paycore Minerals earlier this year, with results to report to market in the near-term. Results from all three areas, Hilltop, Blackjack, and FAD, will be compiled into an inaugural Resource Estimate the middle of next year, showing the size and potential of the polymetallic side of the business.

I-80 Gold also announced on November 7th, that it has entered into a non-binding term sheet in connection with a potential joint venture, with an arm’s length third party, pursuant to which such potential partner will acquire a minority interest in the Company’s Ruby Hill Property located in Eureka County, Nevada. Ewan points out that this process is still underway, stemming from the interest in the polymetallic side of the business, and will help to capitalize many of the other work initiatives for the development at Ruby Hill, which also benefits the gold side of the business.

If you have questions for Ewan regarding the ongoing work and strategy at i-80 Gold Corp, then please email Shad@kereport.com.

* In full disclosure, Shad is an existing shareholder of I-80 Gold Corp at the time of this recording.

.

Click here to see the latest news out of i-80 Gold

.

i-80 Gold Making Moves To Develop Ruby Hill

RocksAndStocksNews – Nov 9, 2023

Sprott Says Central Banks Are Buying Gold At A Torrid Pace

December 05, 2023 – KWN

Paul Wong, Market Strategist at Sprott Asset Management: “On Friday, December 1, 2023, spot gold bullion registered an all-time high closing price of $2,072.22, surpassing the prior closing high of $2,063.54 reached on August 6, 2023. Gold has closed above the three closing highs over the past five years (closing highs: August 6, 2020, at $2,063.54; March 8, 2022, at $2,050.76; May 4, 2023, at $2,050.28) to mark a clear break out from its plus three-year long consolidation range.”

“November was marked by the continuation of violent macro reversals as the broad market retraced all the previous three months’ decline; the U.S. dollar (USD) and yields fell, sparking a risk-on rally and short covering on downside hedges. The Federal Reserve (Fed) and the U.S. Treasury Department sent the market bullish signals on the end of Fed rate hikes, lower QRA (Quarterly Refunding Announcement for Treasury refunding) and a higher issuance skewed to the front end. The result was yields falling (especially the term premium) and a sharp fall in the USD. Combined with the geopolitical containment of the Israel-Hamas war, risk assets soared in the month, including gold.”

https://kingworldnews.com/sprott-central-banks-maintain-torrid-buying-of-gold/

I-80 Gold Corp (TSX: IAU – NYSE: IAUX) – Corporate Presentation:

https://www.i80gold.com/wp-content/uploads/2023/11/i-80-Presentation-November-20-2023.pdf